Lenovo, the world’s fourth-largest PC maker, has long dominated the Chinese market, the world’s second-largest. Lenovo had its worst year in FY 2009 globally and India was no different. Will Lenovo be able to successfully replicate its China business model in India?

Case Contents

- Introduction – Restructuring at Lenovo

- The Indian Challenge

- Rationalizing Operations in India

- About Lenovo – Background note, Business and Strategic Facts

- Lenovo – Top Leadership Team, Key people

- Lenovo: Quick Facts

- Reorganization Strategy and the Boxer analogy

- Lenovo’s Indian focus

- Lenovo’s ‘half moon’ strategy for its emerging markets business

- Lenovo’s three core competitive strengths

- A unique dual business model

- Lean cost structure

- History of innovation

- Marketing Strategy

- Global Marketing Hub – India-based multicultural marketing communications team

- Product positioning – Leveraging icons in the Indian Market

- Five-Year Financial Summary

- Bibliography

- Figure 1 – Lenovo – Sales Analysis by Geography

- Table 1 – India Client PC Market: Vendor Rankings and Market Shares

- Table 2 – India Client PC Market – 4Q 2007, 4Q 2008

- Exhibit 1 – Market share in the overall PC market

- Exhibit 2 – Celebrity Endorsement by PC Brands in India

- Exhibit 3 – Lenovo’s corporate values

Sample Page

“We have restructured our global business and have divided markets into the emerging and developed market categories. Our thrust remains on the emerging market because of the tremendous potential, and we will bring in the best practices from China to these markets. India remains on the top of the pack in our emerging markets business.”- Amar Babu, Lenovo India MD.

“It’s possible to double our share in Indian market in 3-4 years.” – Yang Yuanqing, CEO, Lenovo in July 2009.

“The company’s (Lenovo’s) market share has been on the decline in India for over a year. In the quarter ended Dec. 31, it ranked fifth behind Hewlett-Packard, Dell, Acer, and a local vendor HCL Infosystems.”- Diptarup Chakraborti, principal research analyst at Gartner.

1. Introduction – Restructuring at Lenovo

In January 2006, Lenovo the world’s fourth-largest PC maker restructured its global operations from four regions (Americas, Europe, Asia-Pacific and China) to five . India was a major part of Lenovo’s strategy and it was listed as a separate region to be managed. India had just 7.5 million PCs compared with China’s 40 million. This presented a huge opportunity for Lenovo and it wanted to double its market share in three to four years. The company was expected to find natural success in India as the Indian market was similar in nature to the Chinese market. In China, Lenovo had built a reputation as market leader. Lenovo’s market share in China was over 30% in the Chinese domestic market. According to data compiled by Bloomberg, China accounted for 48% of the company’s revenue for the first half of 2009. However in India, Lenovo was lagging behind competitors like Dell, HP (Hewlett-Packard) and local brands like HCL (Hindustan Computers Limited). Lenovo had a 7.3 per cent share in the Indian PC market.

Download Case Study PDF file to read more.

Case Updates/Snippets

Lenovo India – Retail expansion with LES Lite stores – lower cost stores in tier 3-5 cities

Lenovo India has customized LES Lite stores for the Indian market. These Lite stores are smaller versions of Lenovo’s exclusive stores and have lower costs and also lower break-even points as compared to bigger metro stores. The strategy with Lite stores is to expand into India’s key tier 3-5 cities/towns and are around 150-250 square feet in size. Lenovo launched its Lite stores in Bihar, India in October, 2010 and by April it had around 200 stores. In July 2011, Lenovo India inaugurated its 400th LES Lite store. The company has plans to open 1000 stores by March 2012.

Lenovo leads in India with single largest deal worldwide (Dec quarter 2011)

Lenovo will supply the Tamil Nadu (South Indian State) government with lakhs of laptops. In all, Tamil Nadu state government plans to give away 68 lakh laptops to students in 5 years. Other competitors of Lenovo in India like Acer and HCL are also in line to supply the laptops.

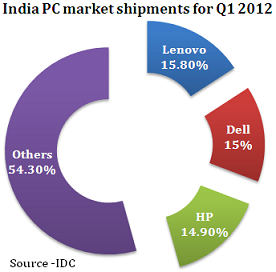

In Q1, 2012, Lenovo India became the No. 1 PC vendor in India.

Business Segments in India

Lenovo has five segments in its enterprise business (known as REL – short for relationship), in India. They are very large enterprises (VLE) (20% share), large enterprises (LE) (10-12% share), government (15% share), education (15% share) and global (30-35%).

Bulk orders and Distribution in India

In 2012, Lenovo’s bulk order from the government of Tamil Nadu for one million laptops and bulk orders from large companies, propelled it as the market leader in India. In India, Lenovo has five national distributors for PCs and around 40 state-specific regional distributors and 6,000 retailers for tablets and smartphones.